Where Strategic Execution Meets Exceptional Results

in Commercial Real Estate Investments

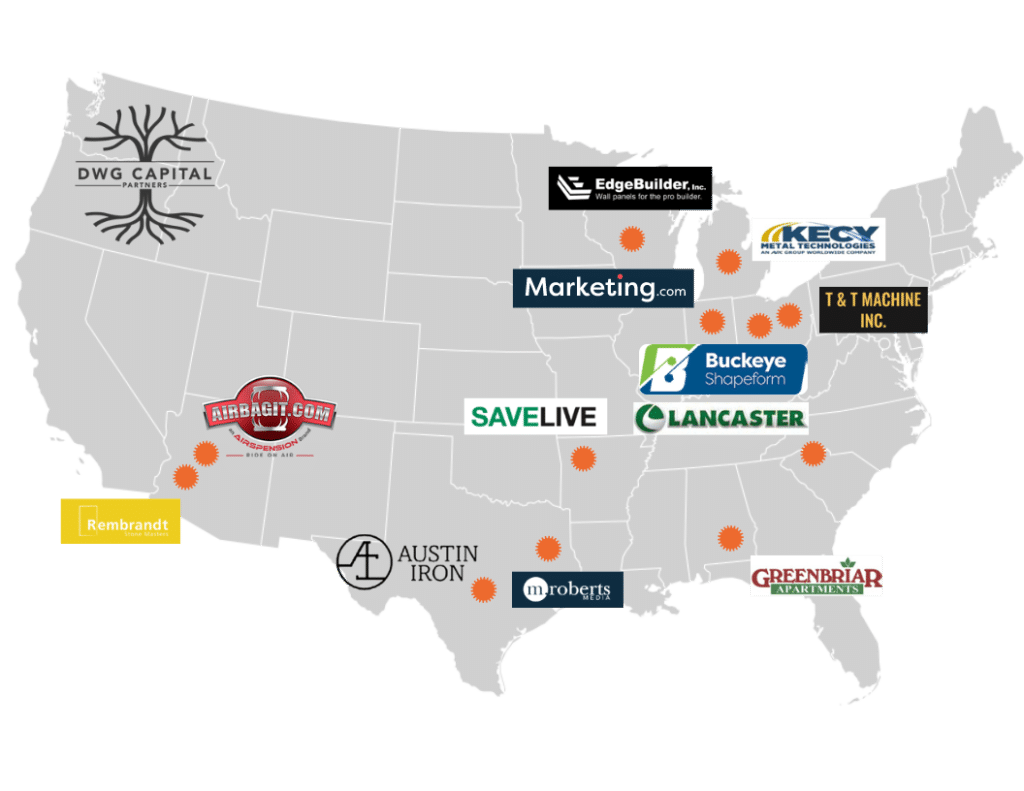

At DWG Capital Partners, our success is built on a foundation of strategic execution and extensive expertise. We take pride in adding substantial value to our structured finance industrial net leased sale-leasebacks and other value-add investments long before the closing stage. This is achieved through innovative practices like securing new leases, optimizing debt rates, and meticulously selecting robust businesses in superior real estate markets. By the time we present a DWG offering to our valued clients, all the groundwork of finding, negotiating, and securing debt, along with crafting a pathway to above-market yields, is already diligently prepared by DWG on our partners’ behalf.

As a result, our DWG equity partners enjoy a simplified opportunity to effortlessly invest in a superior, higher-yielding commercial real estate venture. While you focus on reaping the rewards of a successful investment, our dedicated team at DWG handles all the transactional and management heavy lifting, shouldering the associated loan guarantee risks with our robust internal balance sheet.